BLOG

Dec 18 2024

Residency Based Tax Bill Introduced in Congress

A new bill - HR 10468 - has been introduced to the US Congress by Congressman Darin LaHood (Republican representative from Illinois) -this bill aims to change the US tax code to class US citizens abroad as non-resident US citizens if they so choose. If passed, this bill would make it possible for US citizens to ELECT to be taxed on a Residency basis rather than a Citizenship basis. This is very exciting news for many US citizens but holds many implications for tax changes that need to be weighed for benefits on an individual basis.

Read more and/or join Advocacy Groups:

American Citizens Abroad -  https://www.americansabroad.org/

https://www.americansabroad.org/

Democrats Abroad -  https://www.democratsabroad.org/

https://www.democratsabroad.org/

Republicans Overseas -  https://republicansoverseas.com/

https://republicansoverseas.com/

| |

June 1, 2024

New Minimum Wage in BC as of June 2024 - $17.40 per hour

Here's a great handout from the BC Govt regarding Employer responsibilities regarding employee wages and rights.

Working in BC (gov.bc.ca) - BC Employment Fact sheet

Working in BC (gov.bc.ca) - BC Employment Fact sheet

Working in BC (gov.bc.ca) - BC Employment Standards

Working in BC (gov.bc.ca) - BC Employment Standards

Jan 23 2024

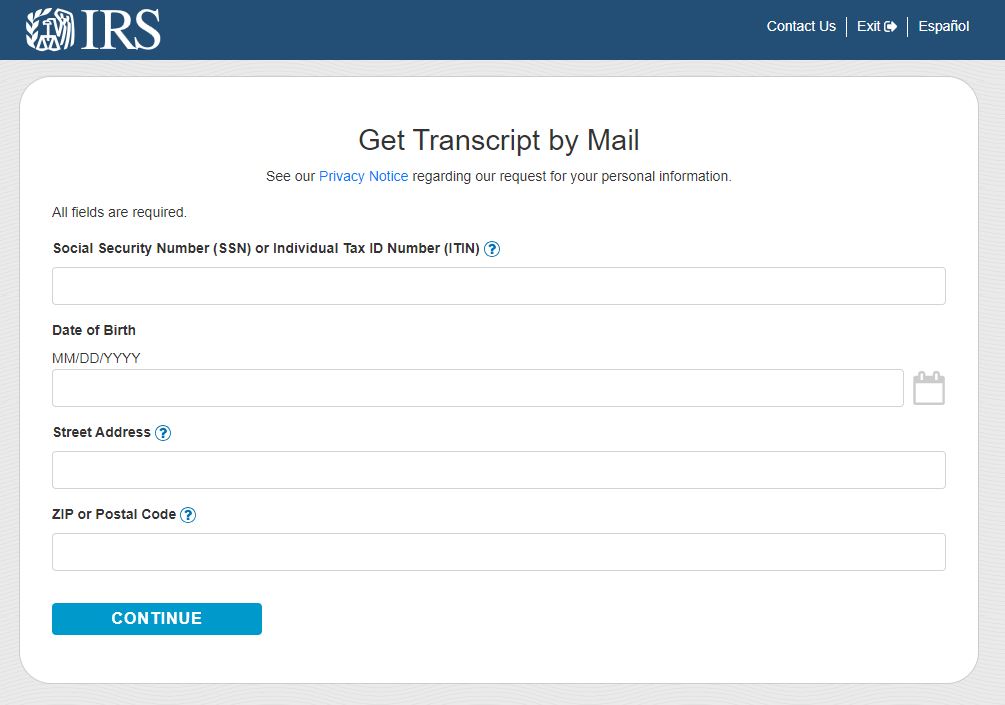

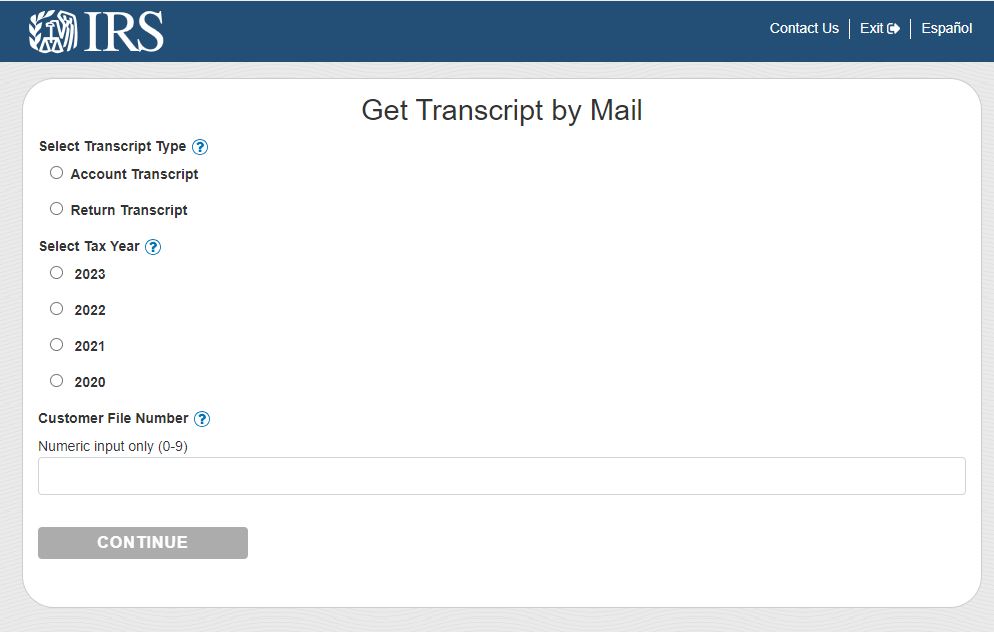

Need your IRS ACCOUNT TRANSCRIPT?

The IRS has a self-request tool that is now active to request ACCOUNT and Return Transcripts to be MAILED to you. Many of our US clients need the ACCOUNT transcript to respond to their CRA Review letters (which are very common when claiming US income and foreign tax credits on your Canadian tax return).

REQUEST IRS ACCOUNT TRANSCRIPT

REQUEST IRS ACCOUNT TRANSCRIPT

If you need your transcript, you can use the tool at the link above to request one of the last 3 years.

Once you have received your transcripts and collected all of your required documents for the review, you can submit the files via your CRA My Account, or if we have authority to access your account, we can upload these documents to CRA for you.

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Dec 21, 2023

CEBA Loan Repayments

The deadline to repay the CEBA loan is January 18, 2024 - this date is final as of the last communication from the government.

Some businesses are required to repay by Dec 31, 2023 - you would have been notified if this was the case for your business.

How to repay your  BMO CEBA Loan

BMO CEBA Loan

Nov 18, 2023

Today was the last day to e-file US tax returns this season - we are still able to paper-file returns with the IRS however.

| |

June 21 2023

The IRS now states that Amended tax returns can take up to 20 weeks to process, as the volume of Amended returns has increased exponentially over last year's numbers. Please have patience as they work through the backlog.

| |

May 15, 2023

Are you a US citizen looking to expatriate from the US?

While we do not offer these services, you can find help. There is a service provider in Calgary --> that can assist you with your questions on how to expatriate.

https://www.facebook.com/MoodysTax

https://www.facebook.com/MoodysTax

| |

Apr 14, 2023

From IRS e-News

Nearly 1.5 million people across the nation have  unclaimed refunds for tax year 2019 but face a July 17, 2023, deadline to submit their tax return. Under the law, taxpayers usually have three years to file and claim their tax refunds. If they don't file within three years, the money becomes the property of the U.S. Treasury.

unclaimed refunds for tax year 2019 but face a July 17, 2023, deadline to submit their tax return. Under the law, taxpayers usually have three years to file and claim their tax refunds. If they don't file within three years, the money becomes the property of the U.S. Treasury.

If you are interested in learning more about this, see this  article. If you have not filed your 2019 tax return and expect a refund, contact us today to see if we can help.

article. If you have not filed your 2019 tax return and expect a refund, contact us today to see if we can help.

June 21, 2022

FinCEN Form 114 - FBAR filing by US citizens living abroad

What is the FBAR?

The FBAR, also called FinCEN Form 114, is the Report of Foreign Bank and Financial Accounts, which is required to be filed by all US citizens living outside the United States if they meet certain financial account thresholds. You must complete an FBAR form if you hold any accounts with an aggregate of $10,000 USD at ANY point during the tax year.

Who sees this report? What is it's purpose?

These forms are submitted to the Department of Treasury Financial Crimes Unit and are typically filed along with your US tax return - they are due APRIL 15th each year, even if your tax return is being filed later due to an extension or is simply being filed late. The purpose of the form is to help identify tax evasion by US citizens. The form is an information disclosure only, and does not have a taxable effect. The contents must be accurate, however, or penalties could apply.

There can be significant penalties, upwards of $10,000 per year, for failing to file these forms yearly or for filing them late. The onus is on the taxpayer to ensure they have provided all details of their accounts accurately on the forms - by signing the form you are indicating acknowledgement of the contents and that the details are accurate.

What type of accounts must be reported?

- chequing and savings accounts

- mutual fund accounts

- life insurance (or other accounts) with cash value

- securities accounts

- any account for which you have POA or signing authority

- RESP accounts

How do I report my accounts?

You can submit the FBAR form yourself, via the BSA E-filing system provided by the  Department of Treasury, or you can provide details to your tax preparer.

Department of Treasury, or you can provide details to your tax preparer.

You will need to report the following items:

- Financial Institution name and address

- Financial account number

- Is it owned individually or jointly? Who is other owner?

- Is is a signing authority only account?

- What is the highest dollar balance in USD for the tax year

- What type of account is it - chequing, saving, retirement, etc

If you wish for us to help you with this form, please provide all of the above details yearly with your tax return documents.

| |

June 15, 2022

Instalment Payments - these are NOT Optional

Have you been notified that you are required to make instalment payments to CRA?

If you have been directed to pay instalment payments, you must endeavor to make these payments in a timely manner. Interest will be calculated on all payments not received on the schedule that is set forth by CRA.

How do I know if I need to make instalment payments?

Generally, if you owe more than $3000 in taxes to CRA in any given year, you will owe instalment payments to "prepay" your expected tax for the next year. The payment is usually equivalent to 4 equal payments to match your previous year's tax due. If you cannot financially manage to make the instalment payment, it is advised that you notify CRA to discuss payment options with them.

You will receive a letter or online notice via My Account that you have instalments due - you should also be informed that instalments will likely be required when you complete your taxes.

| |

Jan 18, 2022

Updated Filing Deadlines for 2022

| Income Tax Filing Deadlines & Benefit Payment Dates | |

|

| |

| All dates are for the current tax year unless specified otherwise. | |

|

|

|

| Canada Child Benefit: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Working Income Tax Benefit payments: | |

| |

|

|

|

|

|

|

|

|

|

| Filing deadlines: |

|

|

|

| |

|

|

|

| GST/HST credit payments: |

|

|

|

|

|

|

|

|

|

|

|

|

| Installment payments due: |

|

|

|

|

|

|

|

|

|

| |

|

|

|

| RRSP contribution deadline: |

|

|

|

| |

US Tax Clients with Charitable Donations

If you are a US tax client and make charitable donations, you can use this  IRS webpage to ensure the charitable organization is recognized for donation deductions on your US return. If the charity is listed in this database and you received a receipt for your donation, you can submit the donation for a deduction.

IRS webpage to ensure the charitable organization is recognized for donation deductions on your US return. If the charity is listed in this database and you received a receipt for your donation, you can submit the donation for a deduction.

April 15, 2021

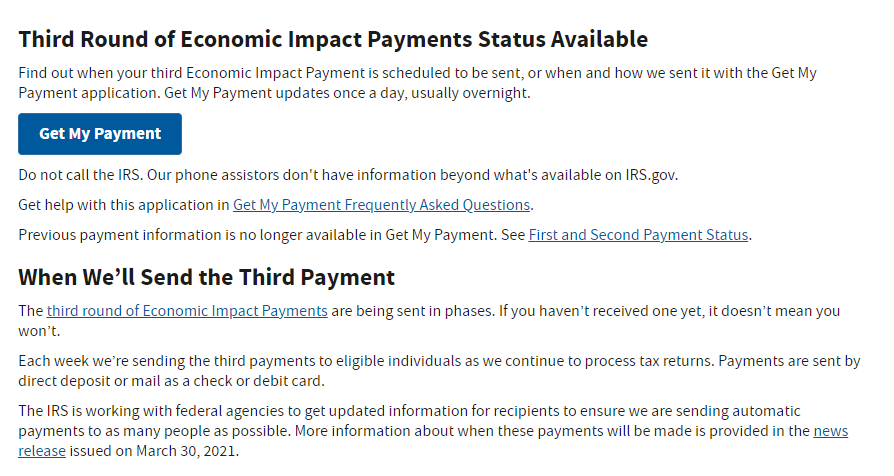

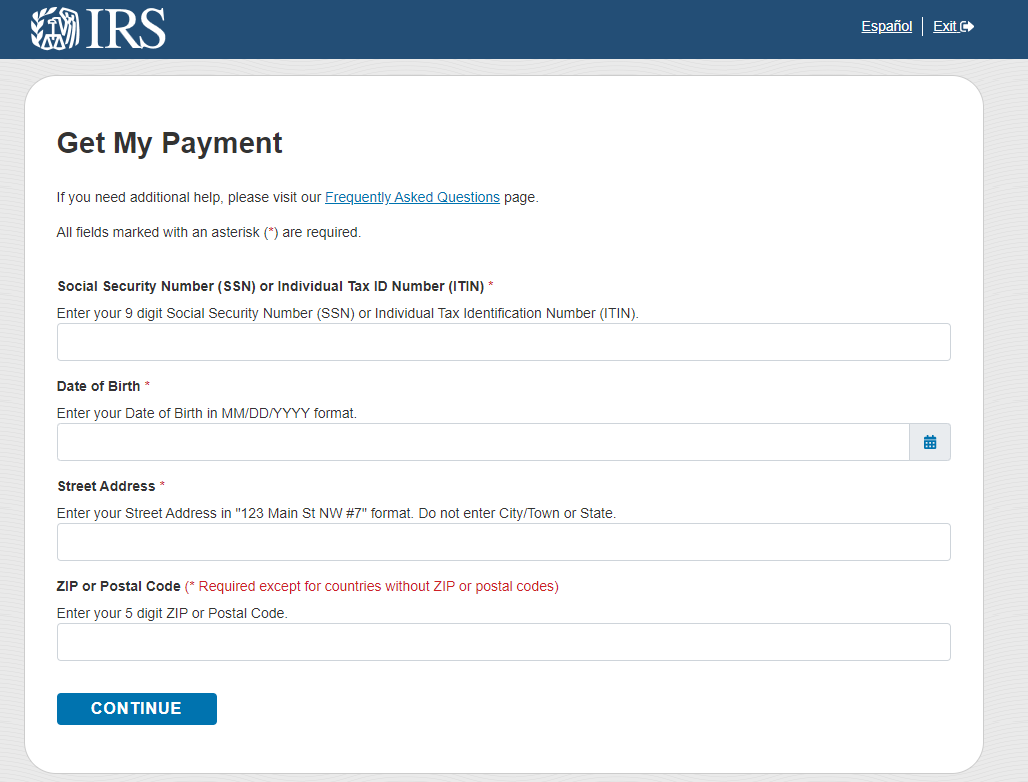

The IRS has extended the US tax filing deadline to May 17, 2021 - plus the 3rd round of Economic Impact payments are now being dispersed

Earlier in April, the IRS announced it will be extending it's filing deadline for US tax returns to May 17, 2021 due to the pandemic. If you are a US expat (or US citizen living abroad), you have an automatic extension until June 15, 2021. However, any amounts owing may collect interest and penalties as of the regular filing deadline of April 15, 2021.

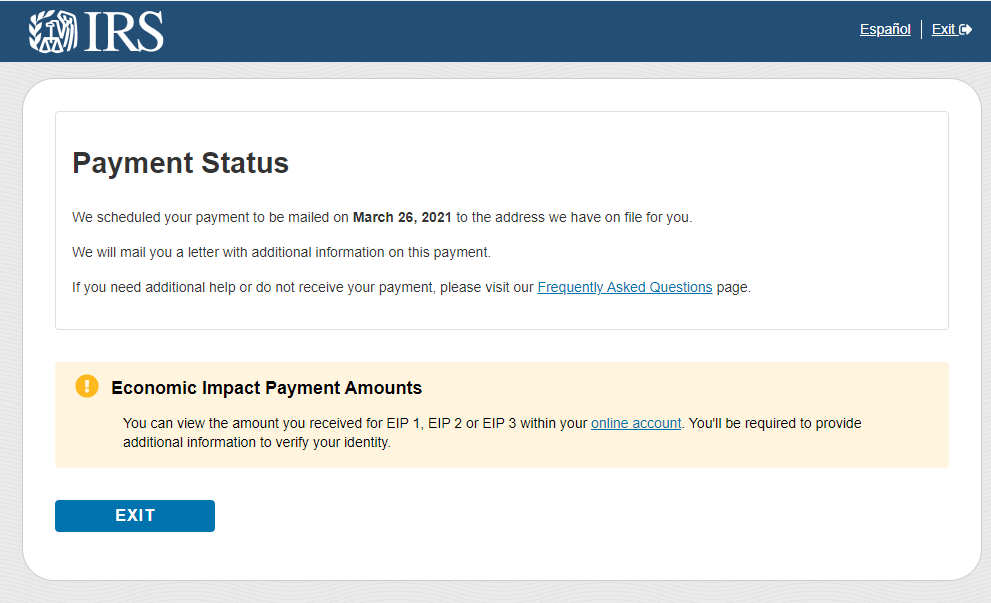

The 3rd and final economic recovery benefit payment is now being dispersed, to eligible individuals/families. You can check your payment status (if you have a SSN) on the IRS website. Below are screen shots of what you will see on their Check your Payment  website. You MUST file a 2020 US tax return to be determine eligibility to receive the benefit, if you have not filed your previous year's returns.

website. You MUST file a 2020 US tax return to be determine eligibility to receive the benefit, if you have not filed your previous year's returns.

Feb 17, 2021

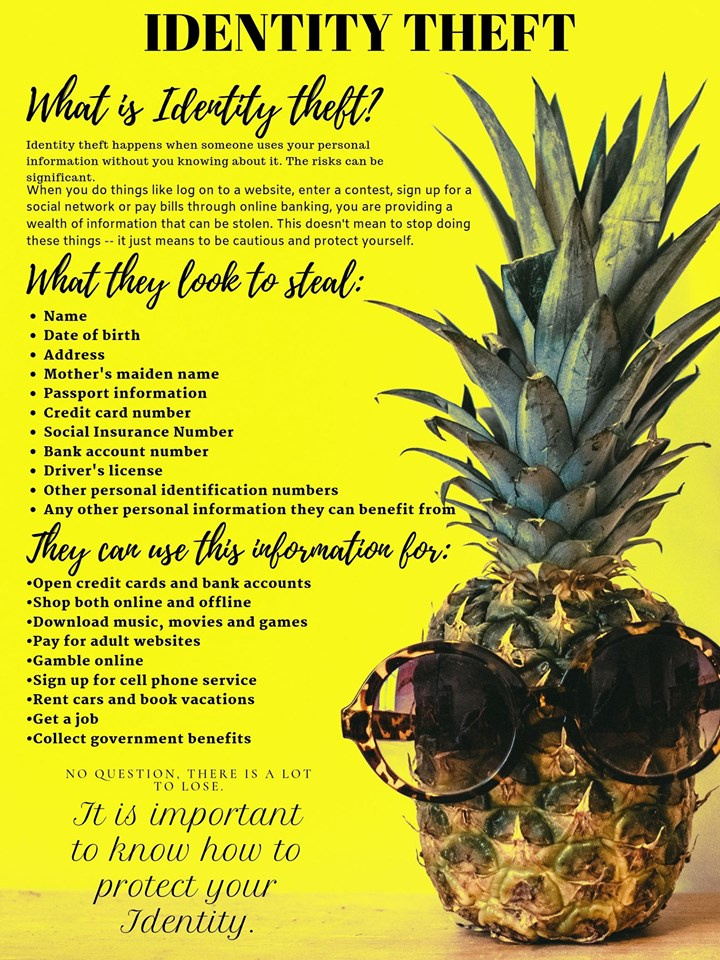

IRS to begin offering Identity Protection Pins starting 2021 (IP PIN)

Beginning in 2021, US tax filers can voluntarily opt into the new IP PIN program - this pin is meant to help protect you from tax-related identity theft. The pin is a 6 digit number that is used when filing your return, so that no one else can use your social security number to file a return in your name.

There is a rigorous identification process required which you can access through your IRS.gov account. If you don't already have an account, you must register online and validate your identity. IP PINs will be available to anyone who has a SSN or an ITIN, and who can verify their identity.

NOTE:

- An IP PIN is valid for one calendar year.

- You must obtain a new IP PIN each year.

- The IP PIN tool is generally unavailable mid-November through mid-January each year.

REGISTER FOR IRS.GOV /  GET YOUR IP PIN

GET YOUR IP PIN

Please note that those living outside the US may need to follow alternate methods to apply as the verification process requires a US based phone number and utility bills, etc -->  IRS Tools

IRS Tools

Alternately, If your income is $72,000 or less, file  Form 15227, Application for an Identity Protection Personal Identification Number PDF. You must have:

Form 15227, Application for an Identity Protection Personal Identification Number PDF. You must have:

- A valid Social Security number or Individual Taxpayer Identification Number

- An adjusted gross income of $72,000 or less

- Access to a telephone

The IRS will use the telephone number provided on the Form 15227 to call you, validate your identity and assign you an IP PIN for the next filing season. For security reasons, the IP PIN cannot be used for the current filing season. You will receive your IP PIN via the U.S. Postal Service the following year and in the future.

Information posted here was sourced from -->  https://www.irs.gov/identity-theft-fraud-scams/get-an-identity-protection-pin

https://www.irs.gov/identity-theft-fraud-scams/get-an-identity-protection-pin

| |

Feb 10, 2021

Yesterday the CRA announced a new Pandemic Benefit Tax Debt Relief program, for individuals earning up to a maximum of $75,000 taxable income, and who received pandemic support benefits during 2020.

This means that any outstanding interest balances for the 2020 tax year will be postponed until April 30, 2022, ONLY for those meeting the criteria and who have filed their 2020 tax returns as usual (by April 30 2021 deadline).

The interest relief measure will be automatically applied for those who meet the criteria.

The pandemic benefits that qualify include:

- CERB - Canada Emergency Response Benefit

- CESB - Canada Emergency Student Benefit

- CRB - Canada Recovery Benefit

- CRCB - Canada Recovery Caregiving Benefit

- CRSB - Canada Recovery Sickness Benefit

- Employment Insurance Benefits

- Similar provincial emergency benefits

If you did not receive pandemic relief benefits, you are still expected to pay your tax and interest by the usual deadline of April 30, 2021.

If you received pandemic benefits and were not eligible for them and did not repay them to the government in 2020 as required, you must report the income on your tax return for 2020. However, if you repay in 2021, an adjustment will be made on your 2021 tax return.

| |

January 2, 2021

EI Sickness Benefits - Temporary Changes effective Sept 27, 2020 - changes will be in effect for 1 year to allow for more people to apply for EI benefits.

EI Sickness Benefits - Temporary Changes effective Sept 27, 2020 - changes will be in effect for 1 year to allow for more people to apply for EI benefits.

The temporary changes include:

- one time credit of 480 insured hours - so you only need 120 insured hours to qualify for benefits (done in order to help meet the required 600 insured hours of work)

- $500 per week pre tax dollars (more possibly)

- if you received CERB benefits, the 52-week period to gather insured hours is extended

- a medical certificate signed by a doctor plus your ROE are required

Read more here ( https://www.canada.ca/en/services/benefits/ei/ei-sickness/apply.html ) to learn how to apply and required documentation

https://www.canada.ca/en/services/benefits/ei/ei-sickness/apply.html ) to learn how to apply and required documentation

| |

Dec 21, 2020

https://www.etax.gov.bc.ca/btp/BCRBP/_/

https://www.etax.gov.bc.ca/btp/BCRBP/_/ - your social insurance number (SIN)

- your B.C. driver's license on hand (if you have one)

- your bank's direct deposit details

- your most recent notice of assessment or reassessment for the 2019 tax year (see line 23600 for NET INCOME)

| |

December 15, 2020

https://ceba-cuec.ca/).

https://ceba-cuec.ca/).- How can I apply for the $20,000 expansion?

Please contact the financial institution that provided you with your original CEBA loan to apply for the $20,000 expansion.

- If my financial institution is not yet offering the $20,000 expansion, can I apply for it elsewhere?

- Do I need to submit a new application for the $20,000 expansion?

You will not need to resubmit your original application, or re-upload expense documents.

| |

The CRA is allowing a NEW FLAT RATE deduction of up to $400 to those individuals working from home as required by their employers. To be eligible you must meet all of the criteria:

- you worked more than 50% of your hours at home for at least a 4 week period ($2 per day)

- only for home office expenses are deductible

You do not have to: calculate the size of your work space, keep supporting documents or get Form T2200 completed and signed by your employer.

Learn more about the simplified process here -->

Government of Canada of News Release

Government of Canada of News Release| |

US Tax Clients - New rules regarding Cash Donations for 2020 tax year

Following tax law changes, cash donations of up to $300 made this year by December 31, 2020 are now deductible without having to itemize when people file their taxes in 2021.

IRS Newsroom Notification -->

IRS Tax Tip 2020-170

IRS Tax Tip 2020-170 The Coronavirus Aid, Relief and Economic Security Act includes several temporary tax law changes to help charities. This includes the special $300 deduction designed especially for people who choose to take the standard deduction, rather than itemizing their deductions.

| |

Are you wondering about the status of your US TAX refund?

Use this link from the IRS.gov website - you will need your SSN, exact Tax Refund $ amount, and filing status -->  US Tax Refund STATUS

US Tax Refund STATUS

| |

Mar 17, 2020

COVID -19 Update

We know many of our clients are feeling uncertain about leaving their homes during this time - therefore we have made some modifications to how we are conducting our business operations in the short-term.

At this time, we are working to create a secure online portal for our clients, which they can use to upload their documents from their computers to streamline the process.

We are encouraging clients to do a quick drop off with their paperwork, if you are healthy to do so. If any appointment is required, it can be held via the telephone, or if an in-person appointment is necessary we will take the precautions to ensure everyone's health.

Feb 28, 2020

Do you have unclaimed payments on your CRA account?

Global News recently reported about a new feature on the CRA website under your My Account profile - where any unclaimed cheques you are owed will be listed, which you can claim. Most of us probably won't see any unclaimed amounts listed, but if you moved and did not notify the CRA, for example, you may have an unclaimed amount.

recently reported about a new feature on the CRA website under your My Account profile - where any unclaimed cheques you are owed will be listed, which you can claim. Most of us probably won't see any unclaimed amounts listed, but if you moved and did not notify the CRA, for example, you may have an unclaimed amount.

If you have online access to your My Account on the CRA website, once you've signed in, you will be presented with the Overview page. On this page, you will see Uncashed Cheques under the Related Items section on the right-hand side of the page. Simply click the link to view any outstanding payments.

Note that any outstanding amounts you owe to CRA will be deducted prior to them issuing any funds outstanding.

Feb 21, 2020

CRA will open their systems to Efile taxes on Feb 24, 2020.

Jan 17, 2020

This year the federal government has changed the TD1 form basic personal exemption amount to be based on a sliding income scale basis.

What is the TD1 form?

This is the form you complete or update under these common circumstances - when you have a new employer, want to change the amount of your exemption or want to increase the amount of tax deducted by your employer.

What does this mean for me?

If you have or expect your 2020 income to be :

- $150, 473 or less during the year, you enter $13,229 on line 1

- $150,474 to $214,368

- you can claim a partial credit using the TD1-WS Worksheet to determine your credit amount for line 1

- you can claim the flat rate of $12,298 if you do not want to calculate a partial credit for line 1

- $214,369 or more, enter $12,298 on line 1

CRA WEBSITE

CRA WEBSITE here

here Jan 15, 2020

Income Tax Filing Deadlines & Benefit Payment Dates

All dates are for the current tax year unless specified otherwise.

Canada Child Benefit:

|

|

Working Income Tax Benefit payments:

- April 5

- July 5

- October 5

- January 5

Filing deadlines:

- April 30 (most filers)

- June 15 (self-employed filers and their spouses or common-law partners)

- June 30 (TFSA return)

GST/HST credit payments:

- January 5

- April 5

- July 5

- October 5

Installment payments due:

- March 15

- June 15

- September 15

- December 15

- December 31 (farmers and fishers pay their yearly installment payment)

RRSP contribution deadline:

- March 2

| |

Dec 18, 2019

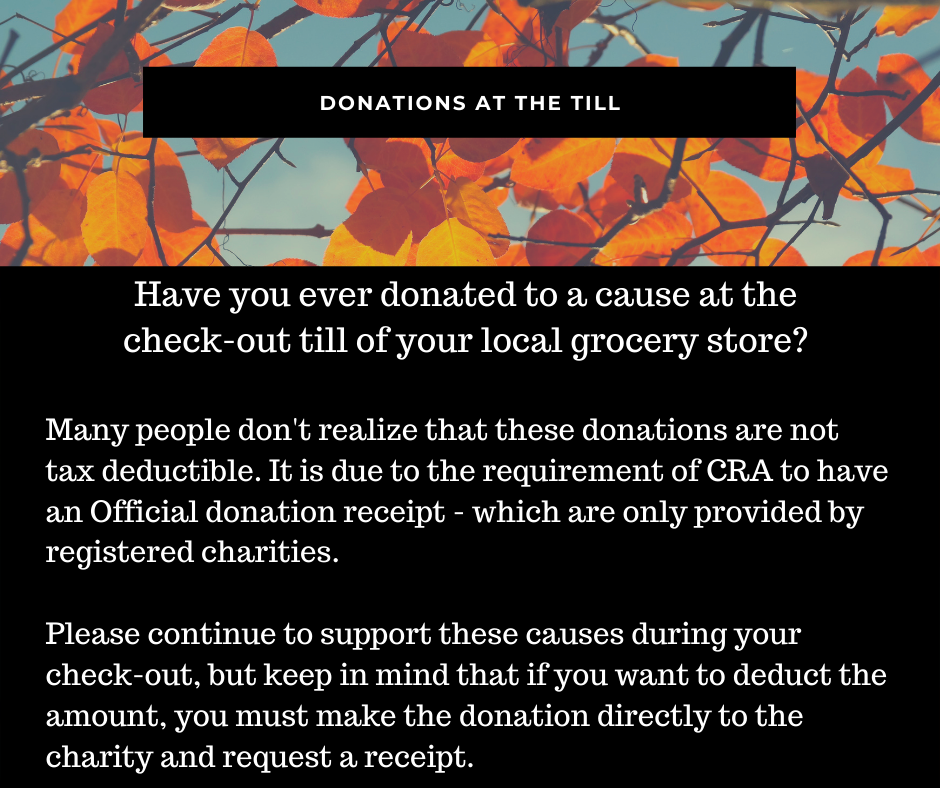

DONATIONS TO CHARITY - WHAT TO BE AWARE OF FOR TAX TIME

Donating to charities is a worthy endeavor, but if you want to claim donations on your tax return, be sure of these key points before handing over any cash.

- The deadline for 2019 receipts is Dec 31, 2019

- In order to claim a donation, you are required to submit a valid receipt (must be registered with CRA)

- Research the charity

here - to ensure it is registered with the CRA

here - to ensure it is registered with the CRA - Generally, tax Credits for donations on the federal return is 15% for the first $200 of annual charitable donations.but jumps to 29% for combined donations of more than $200 in total

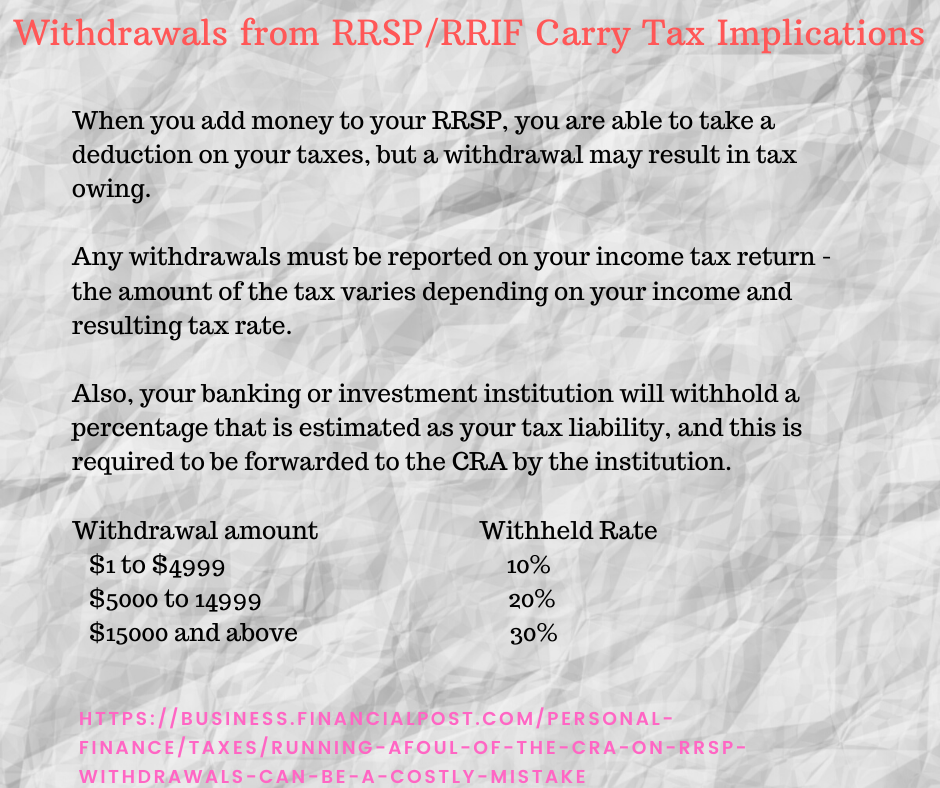

- Tax credits can be applied for donations from RRIFs, RRSP's, Donations in Kind, and Donor Advised Funds - read on

here for more info

here for more info

Read more at the Business Financial Post -->  Make sure your charity of choice has charitable status before making a donation

Make sure your charity of choice has charitable status before making a donation

Oct 29, 2019

| |

October 24, 2019

| |

Oct 19, 2019

Congratulations Jennifer on your graduation!

| |

Sept 23, 2019

Welcome to the team Tamara! We are so happy to have you here at Wish Kwok & Associates!

| |

Sept 20, 2019

EI Premiums are set to decline, according to the CEIC - this is good news for business owners ![]() :)

:)

Read more about this recent announcement on Advisor.ca.

https://www.advisor.ca/…/ei-premiums-decline-again-for-2020/

https://www.advisor.ca/…/ei-premiums-decline-again-for-2020/

| |

July 30, 2019

All Info can be found on:

| |

July 29, 2019

Do you know how to recognize a scam? Here are some tips on how to tell it is NOT the CRA contacting you.

- They will state that your personal information is needed to receive a refund or benefit payment.

- They will use coercive or threatening language to scare individuals into paying fictitious debt to the CRA.

- Some may urge individuals to visit a fake CRA website where the taxpayer is then asked to verify by entering personal information.

Fraud by TELEPHONE - THE CRA MAY:

- verify your identity by asking for personal information such as your full name, date of birth, address and account, or social insurance number

- ask for details about your account, in the case of a business enquiry

- call you to begin an audit process

THE CRA WILL NEVER:

- ask for information about your passport, health card, or driver's license

- demand immediate payment by Interac e-transfer, bitcoin, prepaid credit cards or gift cards from retailers such as iTunes, Amazon, or others

- use aggressive language or threaten you with arrest or sending the police

- leave voicemails that are threatening or give personal or financial information

Fraud by EMAIL -THE CRA MAY:

- notify you by email when a new message or a document, such as a notice of assessment or reassessment, is available for you to view in secure CRA portals such as My Account, My Business Account, or Represent a Client

- email you a link to a CRA webpage, form, or publication that you ask for during a telephone call or a meeting with an agent (this is the only case where the CRA will send an email containing links)

THE CRA WILL NEVER:

- give or ask for personal or financial information by email and ask you to click on a link

- email you a link asking you to fill in an online form with personal or financial details

- send you an email with a link to your refund

- demand immediate payment by Interac e-transfer, bitcoin, prepaid credit cards or gift cards from retailers such as iTunes, Amazon, or others

- threaten you with arrest or a prison sentence

Fraud by MAIL - THE CRA MAY:

- ask for financial information such as the name of your bank and its location

- send you a notice of assessment or reassessment

- ask you to pay an amount you owe through any of the CRA's payment options

- take legal action to recover the money you owe, if you refuse to pay your debt

- write to you to begin an audit process

THE CRA WILL NEVER:

- set up a meeting with you in a public place to take a payment

- demand immediate payment by Interac e-transfer, bitcoin, prepaid credit cards or gift cards from retailers such as iTunes, Amazon, or others

- threaten you with arrest or a prison sentence

The CRA never uses text messages or instant messaging such as Facebook Messenger or WhatsApp to communicate with taxpayers under any circumstance. If a taxpayer receives text or instant messages claiming to be from the CRA, they are scams!

All info can be found on:  https://www.canada.ca/en/revenue-agency.html

https://www.canada.ca/en/revenue-agency.html